Here is a quote from Ryszard Legutko, MEP from the conservative group ECR:

So if this piece de theatre continues I think we will be more and more confused about who and what we are trying to save. Are we trying to save the currency union, Greek society, the credibility of the government, the creditors, the reputation of Angela Merkel, or the infallibility of ever closer-union?

We certainly cannot save all of these. There will be some casualties.

Does Merkel believe that too when she insists, before the Greek proposals are even on the table, that debt relief will not be on the table, neither in the form of a haircut, nor in the form of a maturity extension on the debt? In all but name, this is a flat-out rejection of everything Greece has been saying in the general election and then again in the referendum, and it would appear that she is putting her future ahead of that of the Eurozone. Not so fast! Betting exchanges (unlike brokers) are putting the probability of a Grexit in 2015 at about 35% right now. I agree with them, because there is a solution where Angela Merkel can stick to her word and prove Ryszard Legutko wrong, but wait for it…

First, let’s be clear on the referendum: Even those who vigorously insisted it was an in/out referendum (or that the question wasn’t clear) are now back-pedaling. Greeks prefer to stay in the Eurozone. What then was the meaning of “No”? It was a rejection of a plan that condemned the Greek economy to anemic or negative growth to the extent that Greeks cannot even dream of ever paying off any of their debt. It is just my humble opinion, but the Greeks are a proud people, and not paying the debt to the best of their abilities is not something they are likely to be bargaining for. No, they are bargaining for a framework where their economy can recover so that as much as possible can eventually be repaid. Let’s give them at least that much credit, lest we start calling each other terrorists again.

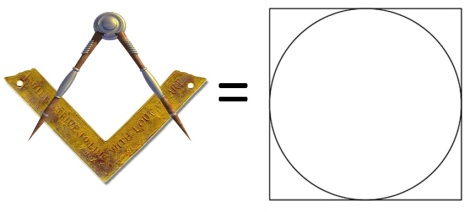

So we need to square the circle: How can Merkel deliver on her promise not to restructure the debt, and the debt become sustainable at the same time? How can both Merkel and Tsipras go home and say they got what they bargained for?

Easy: Roll over old debt, as it comes due, with new debt that is very long-term in nature. Strictly speaking, you have then not restructured anything.

The IMF says the figure which needs to be ‘written off’ is in the range of €50-€60bn. Magically, that is also the amount of debt that falls due in the next three years. By pushing out the maturity of the new debt almost to never-never land you can cut the Greeks some significant slack, technically without reducing the headline debt number. Practically, however, it would afford Greece significant financial breathing room to implement reforms and construct conditions for growth in the next three years. It would also set a healthy deadline by which structural reforms have to take hold and growth has to have resumed at least to the extent that those parts of the current debt which are due in 3 years or more can by then be serviced. Also, you’ll have paid off the IMF automatically in the process (whose loans are short term and super-senior).

Is this likely? Not at present, but it’s the only solution I see, so the next step in the puzzle is “How can Tsipras force their hands?”

For one thing, pushing out the debt doesn’t make it worth zero. You still need to get to the full €50-€60bn number before the IMF will consider things sustainable. So the knock-out punch which Tsipras can deliver tomorrow to clinch this particular deal and get to the full €50-€60bn number would be to voluntarily offer a deposit haircut on Greek deposits held in Greece and abroad. In other words, he — through taxing wealthy Greeks with a one-off ‘solidarity contribution’ (a term which he must surely fall in love with if he read this blog) — would provide ‘his’ part of the €50-€60bn from Greek private resources, with the rest then coming from the deal just described, saving Merkel’s face. My view is that Greeks are braced for a deposit haircut, as long as they can be sure this is buying them a viable road out of the crisis and a place in the Eurozone (if not, just make them consider the alternative!). It would inevitably mean inviting foreign observers into the country, to ensure that the government delivers its part of the bargain in implementing the conditions for economic growth. By and large, the Greek public won’t have a problem with that, and I cannot see how Germany or Finland, who hold all the cards (*) could possibly reject this offer.

Tsipras has been told in no uncertain terms that the new deal will have to involve him putting more things on the table than he has done. More savings is definitely not something he can put on the table without losing face and the faith of all the “No” voters. The deposit haircut is the thing that he can and has to offer, and it will clinch the deal.

Time for Tsipras to step up, and Merkel will have to follow. Lest anyone in Greece still doubts that Europe knows what the score is in Greece, watch Guy Verhofstadt, a true fan of Greece, who also understands better even than most Greeks that all the reticence to make hard choices in Greece has only one victim: the young generation. The hard choice that needs to be made right now is the depositor haircut. (Hats off, by the way, to Tsipras for showing up, and in fact giving an impassioned response: all boding well for European democracy and cooperation for the benefit of Greece).

Then, and only then, Tsipras and the German chancellor would have saved currency union, Greek society, the credibility of the government, the creditors, the reputation of Angela Merkel, and the infallibility of ever closer-union, proving Ryszard Legutko entirely wrong.

—

(*) The countries which have to get any agreement ratified by their parliaments are: Germany, Greece, Portugal, Finland (by absolute majority), Slovenia, and Estonia. Malta may choose to put it before parliament, but doesn’t have to do so.

I wonder how the Greek economy might look if no interest or principal repayments were necessary for, say, five years? Maybe add “long first coupon” to that bond rollover?

LikeLike

There will still be interest repayments on all the longer-term debt, and there haven’t been any principal repayments for some time (they’ve been rolled over since 2010).

LikeLike

And don’t forget to throw in some GDP-linked bonds as well…

Alas, the e-mail to Dijsselbloem doesn’t seem to contain any of these ingredients. Maybe Münchau is right at the end saying that the “nuclear” option is the only one left…

LikeLike

where can I click ‘yes, they should offer a haircut on deposits, but NO, that won’t necessarily get Germany over the line’?

LikeLike