Before the next crunch-time comes for Grexit negotiations on Monday, let’s study why austerity hasn’t worked in Greece, and why Ireland, by contrast, didn’t seem to have suffered adverse consequences.

The openness of an economy is key: In an ‘island economy’, i.e. one with almost no foreign trade (think North Korea or the former East Block), credit contraction will lead directly to economic contraction.

It’s easier to understand the flip-side: The creation of credit accelerates an economy. Let’s start from first principles without the noise of currency union and the lot: Even when ‘official’ currencies didn’t exist yet, people were not condemned to barter and swap only what they could offer on the spot. Before money, people invented credit and debt, in other words the ability to barter one thing today for another tomorrow. One party then ends up owing the delivery of a good or service to the other. This ‘debt’ can then be passed on and accelerate an economy. Let’s see how this works:

Imagine we are in Nova Scotia in the 1630s, and — for argument’s sake, not for the sake of historic accuracy — assume there is no ‘official’ currency. You are a carpenter, and the shoemaker has shoes that you want and could use straight away. He wants a chair, but not those you have in store right now. You have yet to produce that chair, but you agree to trade shoes today against chairs tomorrow. This promise to deliver a chair is an asset to the shoemaker. This asset can help to accelerate the economy not only because you traded with the shoemaker without actually having the chair ready, but more so because he can go and ‘assign’ this debt to someone else whose goods he wants. Say he needs half a carved-up bull for his daughter’s wedding party (you, on the other hand, had no use for this meat). The butcher needs a chair more than a pair of shoes. The butcher may trade his mean in exchange for the chair-tomorrow-promise owned by the shoemaker, eventually getting the chair you have yet to produce, you got something the shoemaker produced, and the shoemaker got something the butcher produced. It’s a triangular trade, and yet the three of you never had to meet and agree a three-party deal. Magic! And we didn’t need a dime (nor a dollar) to make it happen.

The trick is that the butcher and the shoemaker between them had a choice of payment method that go beyond what the shoemaker physically owns or can produce (chairs tomorrow), and when people have more options they are more likely to do a deal and the shoemaker’s daughter’s wedding is rescued. The economy, and the weeding, tick over with the help of a chair that hasn’t yet been produced. Your credit has become a currency, and the ability to swap it for other things makes everyone better off: People are more likely to get what they want and need, without having to agree complicated multi-party deals. As long as you can be trusted to deliver your chair in the end, it works.

So now we immediately understand the converse: If everyone is trying to ‘save’, and no-body wants to owe anything, or if no-one is trustworthy to deliver on their credit promise, no-one gets to trade promises, everyone is back to “Barter 1.0”, and the economy becomes much less efficient and slows down.

Now add foreign trade into the equation: If ‘outsiders’ appear who want chairs, shoes, or meat, but also bring other stuff that’s valuable to the ‘insiders’, trade will accelerate further. That may help you get through the period of credit contraction. For example, say the outsiders have wood which you need to produce your chair, but they only want meat. Chances are the butcher ends up with all the wood. But because it’s worth more to you than to him, he now has another currency to pay you with next time he needs something from you. Foreign trade enhances growth, with or without credit.

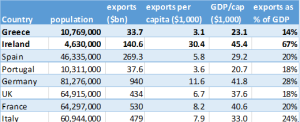

An open economy can therefore much more easily adjust to the economic brakes of shrinking credit volumes or shrinking credit-worthiness, because it has an additional growth drive in the form of external demand. A closed economy does not have that luxury. We didn’t even have to talk about money or currency unions. There, from basic first principles, lies the answer when comparing austerity in Ireland versus Greece. From the table I composed below, we can see how incredibly different the starting position of Greece is from that of Ireland.

Greece has exports of $34bn, and a population of 10.8m. Ireland has exports of $141bn, and a population of 4.6m. On a per capita basis, Ireland has 10x more stuff which outsiders actually buy. That can’t change overnight, especially not if we slow down an economy overwhelmingly dependent on internal trade.

It takes time to change an economy to make it more open, more competitive. What’s worse, the balance between saving more and producing more at cheaper prices might be impossible to strike if your currency can’t reflect your relative weakess.

You may never close the gap to more competitive economies. Even with the best outcome, we must accept that there will always be some difference in countries’ relative competitiveness. There is substantial divergence even within the countries: London vs. the NorthEast, Northern Italy vs. Southern Italy, Paris vs. Brittany, New England vs. the SouthEast of the US, etc.

It is a fact that currency unions, where there is divergence, create a drag on the overall economy. How big that drag is depends on whether other helpful factors are at play: (1) labor mobility, (2) wage flexibility, and (3) money transfers. Labor mobility helps to release the labor force from a shrinking economy so that it can contribute to a growing one, and makes the growing one even more competitive because of an influx of relatively cheaper labor. Wage flexibility helps a weaker economy towards competitiveness and further encourages labor mobility, and money transfers can reduce any remaining imbalance which might be structural (climate, infrastructure, terrain, natural resources, language, etc.) lowering the level of the otherwise inescapable sources of intra-union discontent and further divergence. Another obvious factor is mobility of capital, so that shrinking economies can attract investment through cheaper labor. We could normally ignore this last one, as it’s obviously present in the Eurozone. However, Greece is challenged in attracting foreign investment because of corruption, an inefficient judicial system, and an intransparent set of commercial laws and regulations (which in turn enables yet more corruption). However, at least the EU and the Greek government largely agree on that one.

As to the other factors: Within the EU, labor mobility between European countries is far too low to offset divergent wage inflation, wage flexibility is phenomenally low (although Greece has made spectacular progress on that front), and there are almost zero re-distributive effects: International re-distributive payments from the EU budget pale into insignificance compared to the re-distributive effect of national progressive taxes or social security systems at the intra-national levels. We have no EU-wide, supra-national tax or security system. Each and every one of the three factors needed to offset the economic drag of a currency union is largely absent in the Eurozone.

Which one is easiest to fix? (1) Fixing labor mobility will take decades, because of language differences and still pervasive difference in national accreditation regimes (think lawyers, doctors, professors, etc.). (2) Wage flexibility is difficult with the collective bargaining regimes across the Eurozone, and will never ever match the wage flexibility afforded by a free-floating national currency, where lower competitiveness gets reflected in a lower currency, making goods relatively cheaper for foreigners. (3) With outright money transfers, the huge problem is voter psychology: The masses are relatively blind to the huge transfer mechanisms hidden within national progressive taxes and national social security systems, but are relatively much more sensitive to the much lower explicit transfer payments both within the nations and within the EU.

In the great game of the institutions vs. Greece, options which produce slow results aren’t likely to win the argument. But the only option with a quick result are direct and substantial money transfers. However, the EU does not have that mandate, and will not create that mandate by Monday. It is a quick solution, alas not one which can be implemented quickly.

In summary: Countries with weak exports cannot produce quick (or indeed slow) results while undergoing austerity. Europe can demand whatever it wants from Greece, but Greece won’t be able to deliver. Ireland, as a much more open economy, was at a totally different starting point. Let’s ignore the blame game which will inevitably ensue after Monday. Fact is there was never a third way between the choices of direct money transfers or a collapse of the currency union. Greece is only the bearer of the bad news. Some relatively weaker country had to expose the flaws in the design of the Eurozone, sooner or later.

The choice between money transfers or giving up the single currency is not a choice Greece can make. Yet not other choice will give us meaningful answers. The statements that the “ball is in Greece’s court” (made by both Draghi and Dijsselbloem) or the Mantra of Merkel of “Where there is a will there’s a way?” ignores basic economic principles. Greece, being the debtor, cannot choose debt forgiveness or direct money transfers, and therefore has no more choices to make other than to exit. It needs structural reform, with or without the Euro, but if the Euro is to survive in Greece it needs true debt forgiveness. Greece can’t make that choice. Dressing up more austerity (i.e. more stringent short-term targets) as if it were part of structural reforms, a proof of the serious intent of Greeks to do their part, is a mockery belying economic principles, and only adds repeat insults to five years of almost super-human but counter-productive effort.

This is not a matter of left-wing vs. right-wing. I am not politically aligned with Syriza or any other left-wing party. Quite the opposite: Take one of the most capitalist societies in the world, and ask yourself “why does the currency union work in the US?” Simple: there is more labor mobility, there is more wage flexibility, and there is a federal tax and social security system with much stronger re-distritutive effects than any EU budget could ever produce. Don’t blame the Greeks for that. These are weaknesses of a currency union which does not share these basic features. A union which lacks the basic necessary stabilizers needs much more political will to stay alive than Europe will ever have as long as it makes Greece a scapegoat.

The best outcome this weekend will again be an extremely un-holy compromise where Greece accepts more or less all conditions, but gets a package that buys us at least a year or two before Greece becomes the subject of rampant discussions again. This would be face-saving enough for the Greek government to survive back home, and it would also buy the Eurozone some time to shift the focus from the very necessary, but already largely agreed structural reforms in Greece, to the much more necessary, and completely ignored structural reforms of the construct of the Eurozone. This will take time, and we need Greece off the radar for that to go anywhere. So the deal has to get Grece through the next one to two years.

The Greeks will pay a heavy price, but a lesser one than if they exited now, and one worth paying if, and only if, direct structural payments eventually become part of the very construct of the Eurozone. It is time for the Eurozone to accept that the Euro needs structural reform as much as Greece does, or the extra time gained by such a deal, and by additional Greek sacrifices will be well wasted. All that is a discussion for “the day after”, if the deal manages us to buy the time needed.

Well written! Unfortunately, (European) politicians generally maximize their own utility from a re-election point of view and minimize their inconvenience level and hence rationale economics gets sent to the back burner. It is telling that the view of the unsustainability of the Greek debt matches the one supported Prof Sinn (IFO Institute). As a matter of fact “kicking the can down the road” is probably the worst alternative, but still the most likely as it minimizes the European politicians “inconvenience” level (for the time being at least) as they don’t have to tell their voters the economic truth of their misguided policies…

LikeLike

Pingback: Greece: Why is it so Important? (Part 2) | The Sustainability Report·